HOME > Basketball

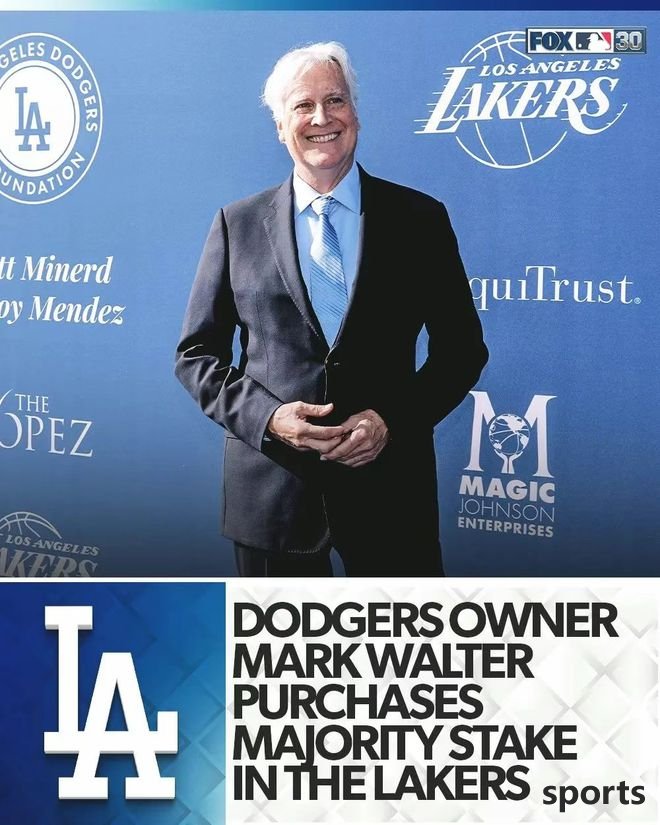

The Bath era is over! Say goodbye to the stingy era, the new Lakers boss sports tycoon + worth only 12 billion

8:37pm, 19 June 2025【Basketball】

NBA ushers in a historic moment! According to famous reporter Shams, the Lakers boss Bass family has reached an agreement with TWG Global CEO and Chairman Mark Walter to sell most of the team's equity for a sky-high price of $10 billion, setting a global professional sports team trading record.

This transaction not only marks the end of the Lakers' "Bass Era", but is also likely to completely change the team's future direction.

Walter's sports investment map has long spanned the world. As chairman of the Los Angeles Dodgers, he led the team to win two World Series titles, turning this veteran powerhouse into a $4 billion sports IP.

Hold the WNBA Los Angeles Sparks team and deeply cultivated the women's professional sports market; in the field of football, he invested in Chelsea in the Premier League, helping the Blues return to the championship ranks; he also involved in niche areas such as racing and ice hockey, and built a business empire covering the five major sports. Now that he extends his tentacles to the NBA, the Lakers are just an important puzzle of his ambition territory.

In 2021, Walter purchased 26% of the Lakers' shares with a strategic perspective, quietly locking in the right of first refusal, and lying in three years ended up becoming the overall situation. As the CEO of Guggenheim Partners, he manages assets of over US$325 billion. With Wall Street's keen sense of smell, he accurately captures the Lakers' business potential as the world's top sports IP.

Although Forbes's net assets are different (6.1 billion to 12 billion US dollars floating), his courage to leverage tens of billions of transactions is far beyond paper wealth.

What is more interesting is Walter's "Invisible Rich" trait.

Unlike the high-profile Ballmer and Cuban, he is deeply behind the scenes and rarely appears in public, but he can always cause storms at critical moments. When acquiring the Dodgers, he used financial leverage to revitalize the team's finances; after taking over Chelsea, the club's revenue increased by 40% through commercial development.

This low-key and pragmatic trading style makes the Lakers full of imagination space in the future - is it to continue the wealthy family's heritage or to start a new model of commercial monetization?

For the Bass family, this may be a win-win deal. The Lakers' valuation soared from $750 million when Jerry Bass died in 2013 to the current sky-high price of 10 billion, with an increase of more than 13 times in 44 years. Walter's acquisition is expected to build the Lakers into a super IP spanning basketball, entertainment and business.

But for fans, the end of the Bath era is a pity. Whether the new boss can continue the championship genes of the Purple and Gold Legion still needs to be questioned.

Related Posts

- What are we talking about? Fans wearing Doncic s Lakers jersey chatted with Mavericks owner Dumont

- Hornets coach: Kneipelmann Sexton has a chance to start and they can play a key role

- Markkanen: Murinen is on the right path and he can make a fortune in the NBA

- Foreign media show James interacting with fans in the rain: Heavy rain cannot stop the whole city from moving to welcome James

- The sixth man once was! Analysis of how Clarkson supports the Knicks substitute attack

- No. 1 in the league! No. 1 in the league! The 24-year-old No. 1 pick is crazy about gaining muscles, he wants to hit the scoring champion + MVP

- Top 100 stars are released!

- What’s the matter! The Warriors quietly strengthened it, and they added 2 more! OK, I can explain it

- Return to the Cavaliers? James statement has caused heated discussion, US media lists 8 potential destinations, and the four top picks are expected to join forces

- 125 million in 5 years! The NBA s first contract of RMB 100 million this summer was born, and the number one player in the draft was counterattacked

Hot Posts

- What are we talking about? Fans wearing Doncic s Lakers jersey chatted with Mavericks owner Dumont

- Hornets coach: Kneipelmann Sexton has a chance to start and they can play a key role

- Markkanen: Murinen is on the right path and he can make a fortune in the NBA

- Foreign media show James interacting with fans in the rain: Heavy rain cannot stop the whole city from moving to welcome James

Recommend

fury! James rushed onto the court to find the referee! Ayton is not afraid of Wen Ban, Doncic scored 35+9+13

Tom: Klingen is still the most preferred center position. Rowe has injured more than 26amp; Yang Hansen s rebound is to be tested

Trail Blazers media person: Yang Hansen only experiences 5 minutes per game, which is not as good as playing 30 minutes in the Development League.

Sun: Carrick finds a new job after leaving Miburg and will serve as commentator in Tottenham s Champions League match

The Rockets have contacted the Bucks to trade Antetokounmpo Stone: The whole team has no products to sell, and all players can choose at will.

Interestingly, economic factors may be one of the reasons why the Knicks struggled to win at home in the playoffs

Knicks and free agent market: Who can they sign with their veteran’s basic salary?

G6 Clippers 111-105 Nuggets, welcome 4 good news after the game! Perfect response to defense, 2 supporting roles are too critical